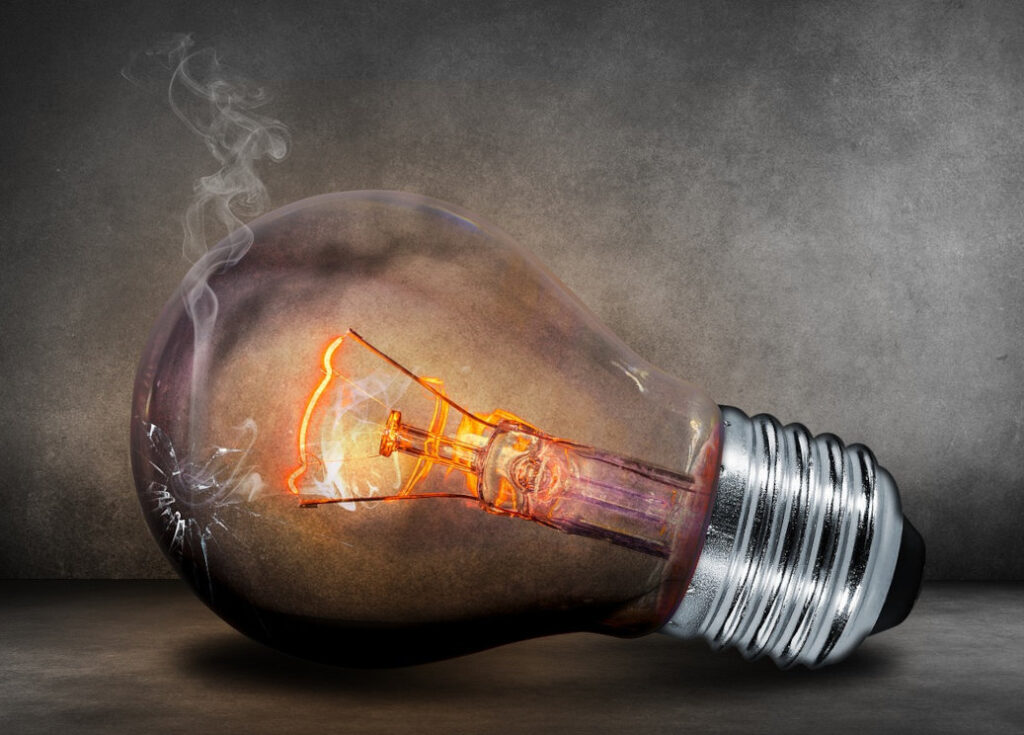

Each year, almost 800 Australians die due to using items that were unsafe due to their production or the way they were sold. The ACCC’s analysis shows fatalities due to faulty products were predominantly a result of:

- Fire, flames, or heat (burns)

- Falls

- Threats to breathing, such as suffocation or choking.

Those fatalities and people hospitalised due to defective products cost the Australian economy about $5 billion annually, according to figures from the Australian Competition and Consumer Commission (ACCC).

This is your guide to retailers’ duty-of-care obligations and responsibilities to ensure you sell safe goods, and what your obligations are if they’re defective and possibly dangerous. Product liability issues can harm your business reputation or worse.

Recent product recall example – Aldi

In mid-September, grocery chain Aldi recalled double USB power points, which had an increased risk of serious injury or death from fire or electrocution. It had sold the Workzone items throughout most of mainland Australia from May to early August. Aldi sources a wide range of tools and items from various companies across the globe for its Workzone label.

This is the ACCC’s official notification webpage which issues public recalls about faulty products. It notes the responsible regulator for the recall as the Office of Fair Trading (NSW). You can also visit Aldi’s Product recall page, which is a useful guide to keep consumers updated and features frequently asked questions and answers.

Who’s liable for product defects?

National and state laws about product defect issues stem from the common law tort of negligence and contract law. These laws aim to protect consumers, not businesses. Product liability is an umbrella term, under which sits manufacturer’s liability.

In effect, product liability casts a net over retailers, wholesalers, suppliers, importers, distributors, and manufacturers, making them legally responsible for products that:

- Are defective and on sale or available to the public

- Result in the buyer experiencing loss, damage, injury or being killed.

And, if the manufacturer is not in Australia, the law places ultimate product liability on the defective product’s importer.

Often, the manufacturer is deemed responsible, but the vendor may also be held liable. Consumers can only take action for damages against a manufacturer. However, they can opt for a broader range of legal remedies against suppliers, which includes retailers. It’s important to know if a consumer lodges a claim but if neither they nor the supplier, can identify the manufacturer in 30 days, the supplier is then regarded as the manufacturer.

Most common liability claims

Typical product liability claims include:

- Defective products, i.e. are not fit for their stated purpose

- Manufacturing defects

- Design issues

- Deficient instructions or warnings

- Warranty breach

- Fraudulent misrepresentation, involving the manufacturer intentionally making false claims (such as through marketing) about the item

- Strict liability, where manufacturers could be held liable for personal injuries their products cause even if they weren’t aware of the possible risks. This type of claim usually covers very dangerous products – poisonous chemicals and explosives, for example.

Consumers generally have three years to lodge a claim from when they:

- Became aware of the loss or defect

- Learned of the manufacturer’s identity.

However, this may vary between states and territories. Different rules apply to children and the court may have discretion to vary.

Consumers will have to prove they or another person using the defective product were injured (or killed) or suffered economic loss or damage. Consumers can take legal action against the manufacturer or make a complaint to a consumer protection agency.

Retailer responsibilities

Retailers are accountable for injuries, harm, or damage that faulty products (they sell or supply) can and do cause. Particularly if they knew or should have known about the issue but did nothing to forewarn consumers.

When a consumer claims against your shop for a defective product, they are entitled to a repair, replacement, refund, or other remedy, under consumer rights and guarantees. Retailers must not mislead consumers about these rights.

By the way, product liability policies have a multi-pronged definition of products that covers:

- Manufacture

- Construction

- Erection

- Assembly

- Installation

- Growth

- Production

- Processing

- Treatment

- Alteration

- Modification

- Repair

- Servicing

- Bottling

- Labelling

- Handling

- Sale

- Supply

- Re-supply

- Distribution

- Import or export by you or on behalf of your business.

Do retailers need product liability insurance?

Product liability is a commercial risk for your retailing business. You can manage these to some extent with due diligence in product sourcing and revisiting your standard terms and conditions to limit your liabilities. You can do that through waivers, acknowledgements, and releases, if they are legal.

Product testing (where appropriate), ensuring you have warnings on dangerous goods, not overreaching with your marketing, as well as regularly reviewing your suppliers will also help. Periodically, do a reverse supply chain analysis to determine the origin of your products. Also, check your contracts with manufacturers and suppliers to see if they include a ‘take back clause’ for faulty items.

Consider investing in the protection that product liability insurance offers. It aims to cover you for compensation you may need to pay to a third party for personal injury or damage resulting from your faulty product. This policy also should cover your legal defence costs, such as legal and experts’ fees, plus court costs.

We can customise a policy to suit your unique business and product lines. Speak with the specialists at Austbrokers Terrace.