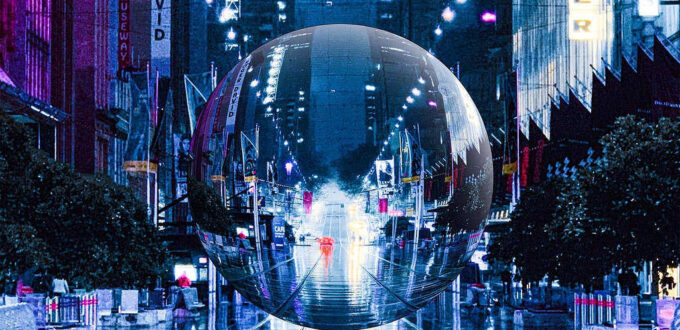

Australia is heading into a high-risk summer, with hotter days, warmer nights, and more rain than usual expected across much of the country. Over the past year, we’ve already seen more than 80 severe weather events. Emergency agencies say flood, storm, and bushfire risks could jump by as much as one third in some regions. […]

Don’t Let Business Blindspots Catch Your SME Off Guard

For Australian SMEs, the biggest threats aren’t always the ones making headlines. Inflation and cyber attacks grab attention, but it’s the unseen risks that can do the most damage. Major legal firms, including Allens, warn that geopolitical shocks, AI governance failures and reputational vulnerabilities are accelerating alongside traditional economic pressures. Cyber and AI Beyond the […]

Happy Chinese New Year 2026

Protecting Tradies is Good for Your Business

St John Ambulance has a handy definition for tradies, saying they include technicians, trade workers, labourers, machinery operators, and drivers. However tradies rate fourth highest for work-related injuries, says the Australian Bureau of Statistics. About a third of workers are tradies, says Safe Work Australia and the Australian Physiotherapy Association. Yet, tradies account for six […]

Is Your Business Ready for the Next Grey Rhino?

The last few years have shown us that COVID 19 was not a one off. Since 2020, businesses have had to navigate a rolling series of shocks, including a global pandemic, war, energy price spikes, supply chain disruption, extreme weather and a steady rise in cyber attacks. Your risk profile does not sit in isolation. […]

Happy New Year

Wishing you and your families a happy, safe and prosperous New Year. The team at Austbrokers Terrace look forward to welcoming you in 2026.

Seasons greetings

With best wishes to you and your families at this festive time from the team at Austbrokers Terrace.

May their spirit live on….in the generations to come

As the stars that shall be bright when we are dust,Moving in marches upon the heavenly plain,As the stars that are starry in the time of our darkness,To the end, to the end, they remain. For the Fallen, Laurence Binyon 1914

The Annual Risk Health Check: Why Every SME Needs It

Your business can change a lot in a year – expanding, shifting online, hiring staff, or upgrading equipment. Yet most SMEs forget to update their insurance when things change. If you set it and forget it, you could be left exposed when something unexpected happens. For example, a tradie leasing new equipment may need additional […]

No Office, No Servers—No Insurance? Think Again

Across Australia, more businesses are operating without offices or in-house servers, choosing cloud-based platforms instead. Remote and flexible work has accelerated this switch for thousands of SMEs. While that shift reduces physical risks, it introduces new ones that traditional insurance often overlooks. Think digital asset loss, business interruption, supply chain dependencies. Depending on third-party providers, […]

Latest Articles

Tools & Tips to Handle Summer Weather Risks Effectively

Don’t Let Business Blindspots Catch Your SME Off Guard

Happy Chinese New Year 2026

Protecting Tradies is Good for Your Business

Is Your Business Ready for the Next Grey Rhino?

Happy New Year

Seasons greetings

The Annual Risk Health Check: Why Every SME Needs It

No Office, No Servers—No Insurance? Think Again

DISCLAIMER

This web site is designed primarily for use by Australian residents. Therefore, some products referred to in this site may be inappropriate for overseas residents. Please contact us via e-mail or phone to discuss your needs should you not be an Australian resident.

The information on this site is for general information purposes only and you should first seek advice from us to determine which products and services are most appropriate for your needs. We take our responsibilities to you seriously, and will work closely with you to customise your program to suit your needs.