The last few years have shown us that COVID 19 was not a one off. Since 2020, businesses have had to navigate a rolling series of shocks, including a global pandemic, war, energy price spikes, supply chain disruption, extreme weather and a steady rise in cyber attacks.

Your risk profile does not sit in isolation. It is part of a bigger system shaped by climate, geopolitics, technology and regulation. It makes sense to strengthen your approach to risk management and to check that your insurance is keeping pace.

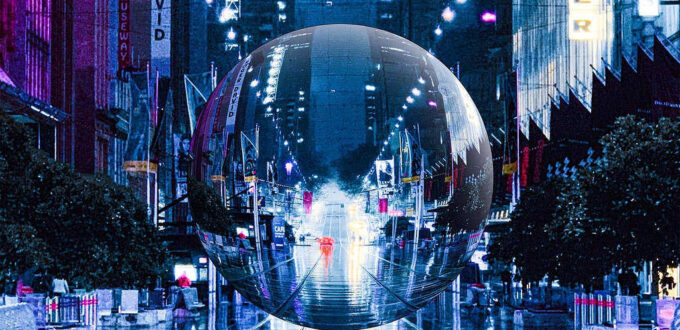

Black Swan or Grey Rhino?

Black swans are outlier events that are tricky to anticipate, let alone plan for. In reality, many of the risks keeping business owners awake now look more like grey rhinos, the term US policy analyst Michele Wucker uses for highly probable, high impact threats that we tend to ignore until they are charging straight at us. What gets in the way are cognitive biases that keep us in denial. Find out more from Wucker’s TED talk.

Business leaders and scholars look to grey rhinos as a reframing of risk to help recover faster from disruption, build resilience, and pinpoint leading indicators. It’s about decreasing the uncertainty of risks that could confront your business.

Risks Have Not Gone Away

COVID 19 has faded from the headlines, but the underlying drivers of pandemic risk have strengthened. Studies of four centuries of disease data suggest there is around a one in three to two in five chance of experiencing a pandemic as intense as COVID 19 in a lifetime.

Climate change is another amplifier. Research shows that more than half of known human infectious diseases can be worsened by climate related hazards such as heatwaves, flooding and drought. Scientists are also warning about a new “age of the panzootic”, where diseases like highly pathogenic bird flu move rapidly between animal species and may spill over into humans.

For business owners, the message is not to panic. It is to treat future health emergencies as one of several predictable grey rhinos that could disrupt your workforce, supply chain and customer base.

More Globally Disruptive Events Likely

Apart from the pandemic, more frequent and severe global disruptions are possible. Such events include:

Military conflicts, and war

Supply chain disruptions

Restrictions to business and consumers (think public health orders, limits to movement etc)

Energy crisis

Cyber attack

International trade war

Natural disasters

Company accident

Time, Early Signals and Your People

There’s another important dimension to that visualisation – time. The lead time between knowing a disruptive event will happen and when it first impacts your business is called detection lead time. It’s the warning period.

Think of trends, such as cyber security. The worldwide move to tighten data obligations will affect Australian businesses, even small-to-medium-sized ones. The Productivity Commission and the Federal Government have foreshadowed this need to boost privacy. While cyber attacks are an unknown threat to each business, tightening laws is a given.

Be sure to look internally as well. Consider, the ‘risk fingerprint’ of each of your staff members. That’s the mix of their personality traits, experiences and social context that feeds into their identity and how they behave. Wucker writes about this in her other book, You Are What You Risk.

Think of the personal qualities of being risk averse, sensitive or even risk blind and how that influences their perceptions of threats and opportunities. Could you be making assumptions about their beliefs about and reactions to risks?

For example, discourage groupthink by sharing safety information across your workplace. That builds a culture encouraging staff to comment and contribute from different perspectives.

Updating Your Risk Management and Insurance

So what does all this mean for your practical risk and insurance decisions this year?

You might consider:

1.Refreshing your risk register using a grey rhino lens, identifying a small set of high impact, plausible disruptions such as another infectious disease outbreak, a major cyber incident, a lengthy supply chain interruption or a climate related disaster.

2.Reviewing your business continuity plan to check it still reflects hybrid working, cloud dependence and key supplier changes.

3.Checking whether your current policies respond to non physical damage events, for example cyber incidents, denial of access or supply chain disruption, rather than only fire and storm.

4.Looking at specialist cover where it suits your circumstances, such as broader cyber and privacy protection, management liability for regulatory exposures, and tailored extensions for infectious disease or event disruption where available.

Speak with Austbrokers Terrace specialists about your business insurance.